7 Ways to Maximize Air Force Colonel Retirement Pay

Understanding Air Force Colonel Retirement Pay

For Air Force Colonels, retirement pay is a significant benefit that can provide financial security and comfort after decades of service. However, maximizing this benefit requires a deep understanding of the retirement pay system and strategic planning. In this post, we will explore seven ways to maximize Air Force Colonel retirement pay.

1. Understanding the Retirement Pay Formula

The retirement pay formula is a critical component of maximizing your benefits. The formula is based on your years of service, final pay grade, and the retirement plan you choose. The formula is as follows:

Retirement Pay = (Years of Service x 2.5%) x Final Pay Grade

For example, if you have 20 years of service and a final pay grade of O-6 (Colonel), your retirement pay would be:

Retirement Pay = (20 x 2.5%) x 10,000 (final pay grade) = 5,000 per month

💡 Note: Understanding the retirement pay formula is crucial in maximizing your benefits. It's essential to review and understand the formula to make informed decisions about your retirement.

2. Choosing the Right Retirement Plan

The Air Force offers two retirement plans: the High-3 Year Average plan and the REDUX plan. The High-3 Year Average plan is the default plan, which calculates retirement pay based on the average of your highest 36 months of basic pay. The REDUX plan, on the other hand, offers a $30,000 bonus at the 15-year mark, but reduces the retirement pay multiplier from 2.5% to 2%.

High-3 Year Average Plan

- Pros: Higher retirement pay multiplier (2.5%)

- Cons: No bonus at the 15-year mark

REDUX Plan

- Pros: $30,000 bonus at the 15-year mark

- Cons: Lower retirement pay multiplier (2%)

📝 Note: Choosing the right retirement plan depends on your individual circumstances and financial goals. It's essential to review and compare both plans to make an informed decision.

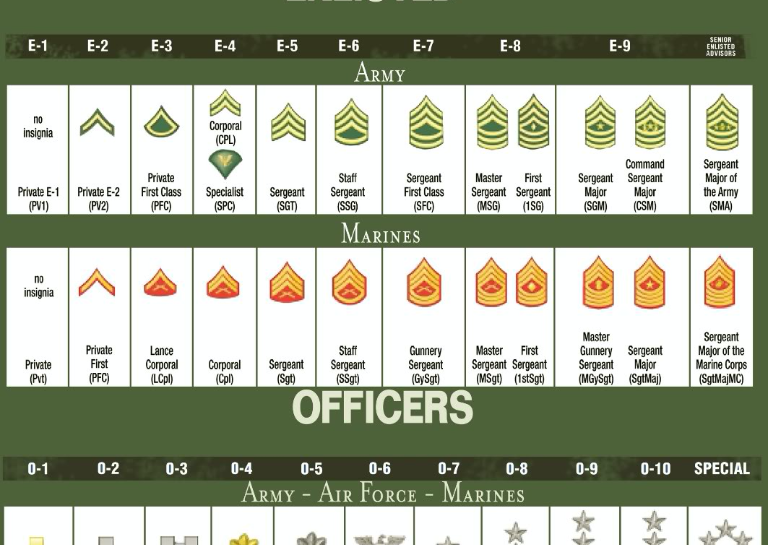

3. Increasing Your Final Pay Grade

Your final pay grade plays a significant role in determining your retirement pay. Increasing your final pay grade can significantly boost your retirement pay. Here are some ways to increase your final pay grade:

- Promotions: Seek promotions to higher pay grades, such as O-7 (Brigadier General) or O-8 (Major General).

- Special Pays: Take advantage of special pays, such as hazardous duty pay or special skill pay, to increase your basic pay.

- Longevity Pay: Serve longer to increase your longevity pay, which is based on your years of service.

4. Maximizing Your Years of Service

Your years of service are a critical component of the retirement pay formula. Maximizing your years of service can significantly boost your retirement pay. Here are some ways to maximize your years of service:

- Serve longer: Serve beyond the 20-year mark to increase your years of service.

- Countable time: Ensure that all your time in service is countable towards your retirement pay.

5. Taking Advantage of Thrift Savings Plan (TSP) Matching

The Thrift Savings Plan (TSP) is a retirement savings plan that offers matching contributions from the Air Force. Contributing to the TSP and taking advantage of the matching contributions can significantly boost your retirement savings.

- Contribute to TSP: Contribute to the TSP to take advantage of the matching contributions.

- Maximize matching contributions: Maximize your matching contributions by contributing at least 5% of your basic pay.

6. Utilizing the Post-9/11 GI Bill

The Post-9⁄11 GI Bill is an education benefit that can provide up to 36 months of education assistance. Utilizing the Post-9⁄11 GI Bill can help you acquire new skills or pursue higher education, which can increase your earning potential and boost your retirement savings.

- Transfer benefits: Transfer your Post-9⁄11 GI Bill benefits to your dependents or use them yourself.

- Education assistance: Use the education assistance to acquire new skills or pursue higher education.

7. Planning for Healthcare and Insurance

Healthcare and insurance costs can significantly impact your retirement savings. Planning for healthcare and insurance can help you minimize these costs and maximize your retirement savings.

- TRICARE: Utilize TRICARE, the military’s healthcare program, to minimize healthcare costs.

- Insurance: Take advantage of insurance options, such as life insurance and disability insurance, to protect your retirement savings.

What is the retirement pay formula for Air Force Colonels?

+

The retirement pay formula is based on your years of service, final pay grade, and the retirement plan you choose. The formula is as follows: Retirement Pay = (Years of Service x 2.5%) x Final Pay Grade.

What is the difference between the High-3 Year Average plan and the REDUX plan?

+

The High-3 Year Average plan calculates retirement pay based on the average of your highest 36 months of basic pay, while the REDUX plan offers a $30,000 bonus at the 15-year mark, but reduces the retirement pay multiplier from 2.5% to 2%.

How can I increase my final pay grade?

+

You can increase your final pay grade by seeking promotions to higher pay grades, taking advantage of special pays, and serving longer to increase your longevity pay.

By understanding the retirement pay formula, choosing the right retirement plan, increasing your final pay grade, maximizing your years of service, taking advantage of TSP matching, utilizing the Post-9⁄11 GI Bill, and planning for healthcare and insurance, you can maximize your Air Force Colonel retirement pay and enjoy a financially secure retirement.