Alabama Paycheck Calculator: Free and Easy to Use Tool

Calculating Your Alabama Paycheck: A Simplified Guide

Calculating your paycheck can be a daunting task, especially when considering the various taxes and deductions that come into play. In Alabama, the process can be complex, but with the right tools, it can be made much simpler. In this article, we will explore the ins and outs of using an Alabama paycheck calculator, a free and easy-to-use tool that can help you determine your take-home pay.

Understanding Alabama Payroll Taxes

Before diving into the calculator, it’s essential to understand the different taxes and deductions that are taken out of your paycheck in Alabama. These include:

- Federal Income Tax: A tax levied by the federal government on your income.

- Alabama State Income Tax: A tax levied by the state of Alabama on your income.

- Social Security Tax: A tax used to fund social security programs.

- Medicare Tax: A tax used to fund Medicare programs.

- Other Deductions: Such as health insurance, retirement plans, and other benefits.

📝 Note: These taxes and deductions can vary depending on your income level, filing status, and other factors.

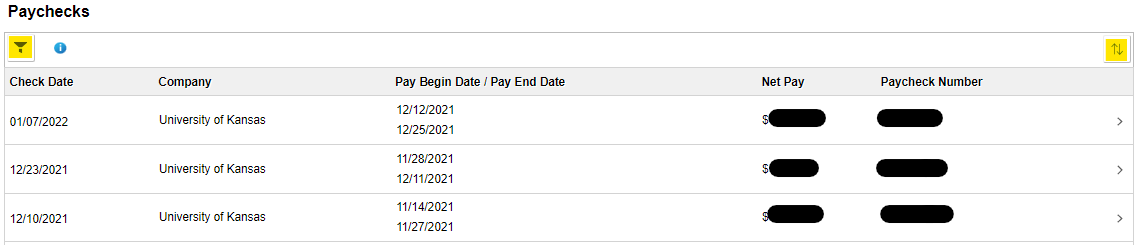

How to Use the Alabama Paycheck Calculator

Using the Alabama paycheck calculator is straightforward and requires only a few pieces of information. Here’s a step-by-step guide:

- Gross Income: Enter your gross income, which is your total income before taxes and deductions.

- Pay Frequency: Select how often you are paid, whether it’s weekly, bi-weekly, or monthly.

- Filing Status: Choose your filing status, such as single, married, or head of household.

- Dependents: Enter the number of dependents you claim.

- Tax Credits: Enter any tax credits you are eligible for, such as the Earned Income Tax Credit (EITC).

| Input | Description |

|---|---|

| Gross Income | Your total income before taxes and deductions |

| Pay Frequency | How often you are paid (weekly, bi-weekly, monthly) |

| Filing Status | Your filing status (single, married, head of household) |

| Dependents | The number of dependents you claim |

| Tax Credits | Any tax credits you are eligible for (EITC, etc.) |

Benefits of Using the Alabama Paycheck Calculator

Using the Alabama paycheck calculator offers several benefits, including:

- Accurate Calculations: The calculator provides accurate calculations of your take-home pay, taking into account all the necessary taxes and deductions.

- Easy to Use: The calculator is user-friendly and requires only a few pieces of information to get started.

- Free: The calculator is free to use, with no hidden fees or charges.

- Convenient: The calculator can be accessed online, making it convenient to use from anywhere.

💡 Note: The calculator is not intended to provide tax advice, but rather to provide an estimate of your take-home pay.

As we conclude, the Alabama paycheck calculator is a valuable tool for anyone looking to determine their take-home pay. By following the simple steps outlined above, you can get an accurate estimate of your paycheck and plan your finances accordingly.

What is the Alabama paycheck calculator?

+

The Alabama paycheck calculator is a free online tool that helps you estimate your take-home pay based on your gross income, pay frequency, filing status, dependents, and tax credits.

How accurate is the calculator?

+

The calculator provides accurate calculations based on the information you enter. However, it’s essential to note that the calculator is not intended to provide tax advice, but rather to provide an estimate of your take-home pay.

Can I use the calculator for other states?

+

No, the calculator is specifically designed for Alabama and takes into account the state’s tax laws and regulations. If you need to calculate your paycheck for another state, you may need to use a different calculator or consult with a tax professional.