Simplify Financial Reporting with Consistency

Simplify Financial Reporting with Consistency

Financial reporting is a critical aspect of any business, providing stakeholders with valuable insights into the company’s performance and financial health. However, preparing financial reports can be a complex and time-consuming process, especially for companies with multiple subsidiaries, divisions, or geographic locations. Inconsistent financial reporting can lead to confusion, errors, and delays, ultimately affecting business decisions and growth.

The Importance of Consistency in Financial Reporting

Consistency is key to accurate and reliable financial reporting. It enables stakeholders to easily compare and analyze financial data across different periods, making it easier to identify trends, patterns, and anomalies. Consistency also helps to:

- Improve transparency: Consistent financial reporting provides a clear and comprehensive view of the company’s financial performance, enabling stakeholders to make informed decisions.

- Reduce errors: Consistency minimizes the risk of errors and inaccuracies, ensuring that financial reports are reliable and trustworthy.

- Enhance comparability: Consistent financial reporting enables stakeholders to compare financial data across different periods, making it easier to analyze performance and make informed decisions.

Challenges in Achieving Consistency

Despite the importance of consistency in financial reporting, many companies face challenges in achieving it. Some common challenges include:

- Multiple accounting standards: Companies operating in different countries or regions may need to comply with multiple accounting standards, making it difficult to achieve consistency.

- Diverse business operations: Companies with diverse business operations, such as multiple subsidiaries or divisions, may struggle to achieve consistency in financial reporting.

- Lack of standardization: Inadequate standardization of financial reporting processes and procedures can lead to inconsistencies and errors.

Best Practices for Achieving Consistency in Financial Reporting

To achieve consistency in financial reporting, companies can follow these best practices:

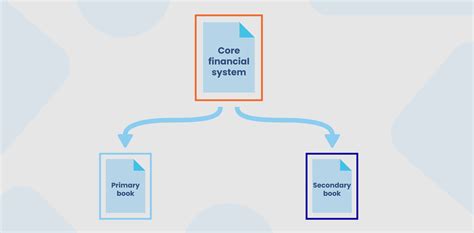

- Establish a centralized financial reporting system: Implement a centralized financial reporting system that can consolidate and standardize financial data from multiple sources.

- Develop a comprehensive financial reporting framework: Establish a comprehensive financial reporting framework that outlines the company’s financial reporting policies, procedures, and standards.

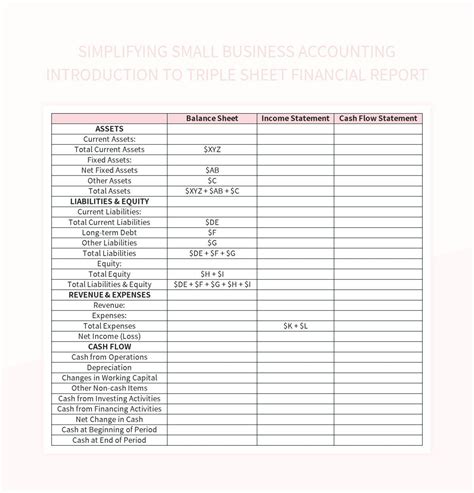

- Use standardized financial reporting templates: Use standardized financial reporting templates to ensure consistency in the presentation and format of financial reports.

- Provide regular training and support: Provide regular training and support to financial reporting teams to ensure that they understand the company’s financial reporting policies, procedures, and standards.

| Best Practice | Description |

|---|---|

| Establish a centralized financial reporting system | Implement a centralized financial reporting system to consolidate and standardize financial data from multiple sources. |

| Develop a comprehensive financial reporting framework | Establish a comprehensive financial reporting framework that outlines the company's financial reporting policies, procedures, and standards. |

| Use standardized financial reporting templates | Use standardized financial reporting templates to ensure consistency in the presentation and format of financial reports. |

| Provide regular training and support | Provide regular training and support to financial reporting teams to ensure that they understand the company's financial reporting policies, procedures, and standards. |

Benefits of Consistency in Financial Reporting

Achieving consistency in financial reporting can bring numerous benefits to companies, including:

- Improved transparency and accountability: Consistent financial reporting provides a clear and comprehensive view of the company’s financial performance, enabling stakeholders to make informed decisions.

- Enhanced credibility: Consistent financial reporting enhances the company’s credibility and reputation, making it more attractive to investors, customers, and partners.

- Better decision-making: Consistent financial reporting enables stakeholders to make informed decisions, ultimately driving business growth and success.

💡 Note: Consistency in financial reporting is not a one-time achievement, but rather an ongoing process that requires continuous monitoring and improvement.

By following these best practices and achieving consistency in financial reporting, companies can simplify the financial reporting process, reduce errors and inaccuracies, and provide stakeholders with a clear and comprehensive view of the company’s financial performance.

In summary, consistency is key to accurate and reliable financial reporting. By establishing a centralized financial reporting system, developing a comprehensive financial reporting framework, using standardized financial reporting templates, and providing regular training and support, companies can achieve consistency in financial reporting and reap the benefits of improved transparency, accountability, credibility, and decision-making.

What is the importance of consistency in financial reporting?

+

Consistency in financial reporting is important because it enables stakeholders to easily compare and analyze financial data across different periods, making it easier to identify trends, patterns, and anomalies.

What are some common challenges in achieving consistency in financial reporting?

+

Some common challenges in achieving consistency in financial reporting include multiple accounting standards, diverse business operations, and lack of standardization.

What are some best practices for achieving consistency in financial reporting?

+

Some best practices for achieving consistency in financial reporting include establishing a centralized financial reporting system, developing a comprehensive financial reporting framework, using standardized financial reporting templates, and providing regular training and support.