5 Ways Cox Ingersoll Ross Model Boosts Investment Strategies

Understanding the Cox Ingersoll Ross Model

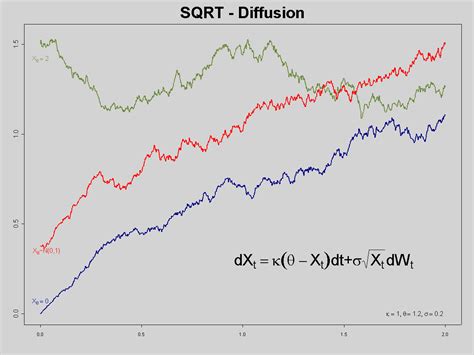

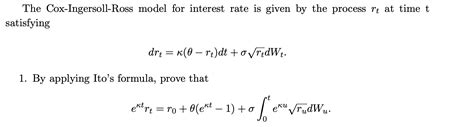

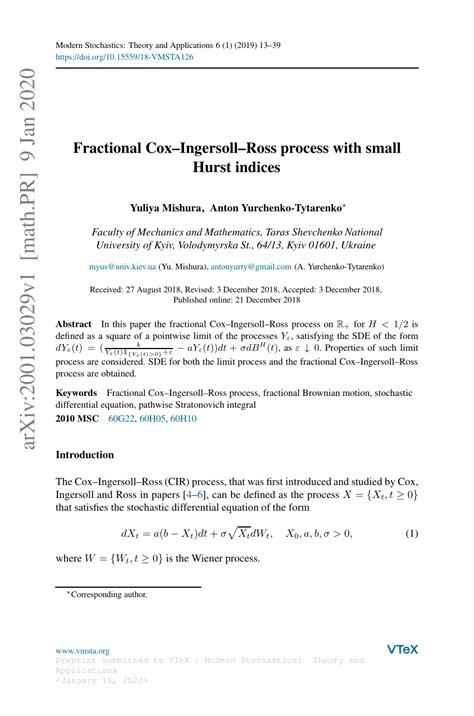

The Cox Ingersoll Ross (CIR) model is a mathematical model used to describe the evolution of interest rates over time. It was developed by John C. Cox, Jonathan E. Ingersoll, and Stephen A. Ross in 1985 as an extension of the Vasicek model. The CIR model is widely used in finance to price interest rate derivatives, such as bonds, options, and futures. In this article, we will explore five ways the Cox Ingersoll Ross model can boost investment strategies.

Advantages of the Cox Ingersoll Ross Model

The CIR model has several advantages that make it a popular choice among investors and financial institutions. Some of the key benefits include:

- Mean-reverting property: The CIR model assumes that interest rates will revert to their long-term mean over time, which is a more realistic assumption than the Vasicek model.

- Non-negative interest rates: The CIR model ensures that interest rates are always non-negative, which is a critical feature for pricing interest rate derivatives.

- Flexibility: The CIR model can be calibrated to fit a wide range of interest rate environments, making it a versatile tool for investment strategies.

5 Ways the Cox Ingersoll Ross Model Boosts Investment Strategies

1. Improved Interest Rate Risk Management

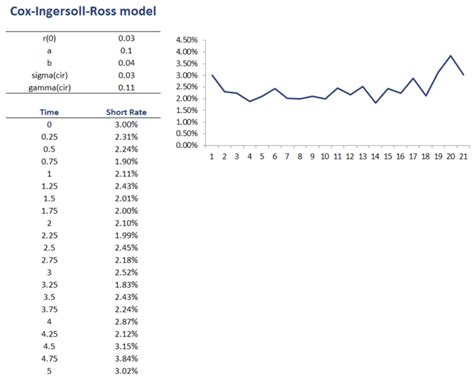

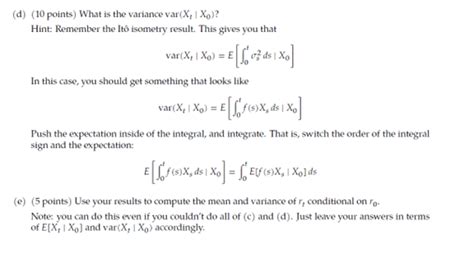

The CIR model can help investors manage interest rate risk more effectively by providing a more accurate representation of interest rate dynamics. By using the CIR model to simulate different interest rate scenarios, investors can better hedge their positions and reduce their exposure to interest rate risk.

📈 Note: The CIR model can be used in conjunction with other risk management tools, such as duration analysis and convexity analysis, to provide a more comprehensive view of interest rate risk.

2. Enhanced Yield Curve Analysis

The CIR model can be used to analyze the yield curve, which is a critical component of investment strategies. By using the CIR model to estimate the yield curve, investors can gain insights into the expected future path of interest rates and make more informed investment decisions.

- Key yield curve metrics: The CIR model can be used to estimate key yield curve metrics, such as the term premium and the expected future short rate.

- Yield curve scenarios: The CIR model can be used to simulate different yield curve scenarios, which can help investors stress-test their portfolios and prepare for different market outcomes.

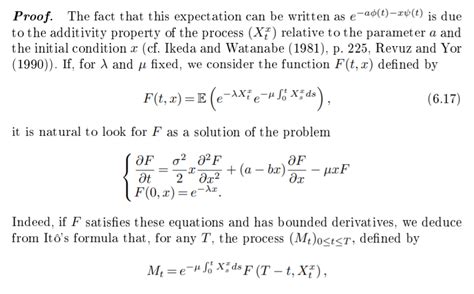

3. Better Pricing of Interest Rate Derivatives

The CIR model can be used to price interest rate derivatives, such as bonds, options, and futures. By using the CIR model to estimate the price of these derivatives, investors can make more informed investment decisions and reduce their exposure to interest rate risk.

- Key pricing metrics: The CIR model can be used to estimate key pricing metrics, such as the option-adjusted spread and the expected future value of the derivative.

- Sensitivity analysis: The CIR model can be used to perform sensitivity analysis, which can help investors understand how changes in interest rates and other market factors affect the price of the derivative.

4. Improved Asset Allocation

The CIR model can be used to improve asset allocation decisions by providing a more accurate representation of interest rate risk. By using the CIR model to estimate the expected return and risk of different assets, investors can make more informed asset allocation decisions and reduce their exposure to interest rate risk.

- Key asset allocation metrics: The CIR model can be used to estimate key asset allocation metrics, such as the expected return and risk of different assets.

- Asset allocation scenarios: The CIR model can be used to simulate different asset allocation scenarios, which can help investors stress-test their portfolios and prepare for different market outcomes.

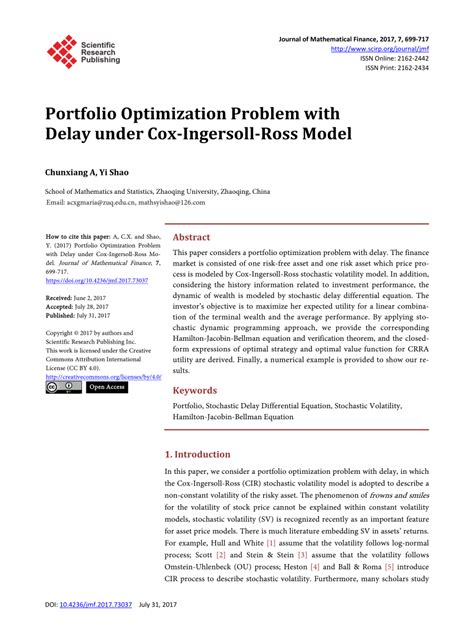

5. Enhanced Portfolio Optimization

The CIR model can be used to optimize portfolios by providing a more accurate representation of interest rate risk. By using the CIR model to estimate the expected return and risk of different portfolios, investors can make more informed portfolio optimization decisions and reduce their exposure to interest rate risk.

- Key portfolio optimization metrics: The CIR model can be used to estimate key portfolio optimization metrics, such as the expected return and risk of different portfolios.

- Portfolio optimization scenarios: The CIR model can be used to simulate different portfolio optimization scenarios, which can help investors stress-test their portfolios and prepare for different market outcomes.

Conclusion

The Cox Ingersoll Ross model is a powerful tool for investment strategies, offering a more accurate representation of interest rate risk and dynamics. By using the CIR model, investors can improve their interest rate risk management, enhance their yield curve analysis, better price interest rate derivatives, improve their asset allocation decisions, and optimize their portfolios. Whether you are a seasoned investor or just starting out, the CIR model is an essential tool to have in your investment strategy toolkit.

What is the Cox Ingersoll Ross model?

+

The Cox Ingersoll Ross (CIR) model is a mathematical model used to describe the evolution of interest rates over time.

What are the advantages of the CIR model?

+

The CIR model has several advantages, including its mean-reverting property, non-negative interest rates, and flexibility.

How can the CIR model be used in investment strategies?

+

The CIR model can be used to improve interest rate risk management, enhance yield curve analysis, better price interest rate derivatives, improve asset allocation decisions, and optimize portfolios.