5 Simple Ways to Track Debt Payments

Taking Control of Your Finances: Tracking Debt Payments Made Easy

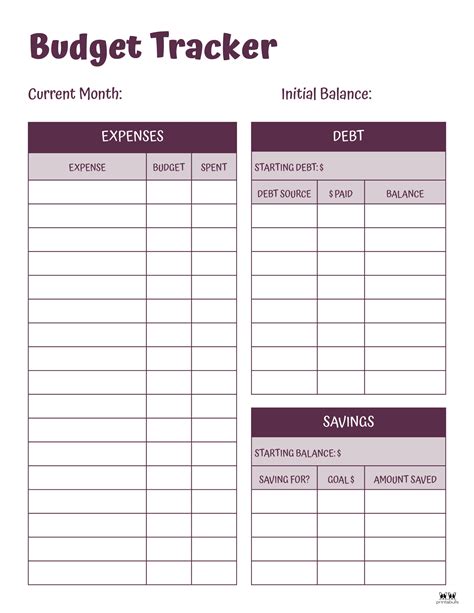

Managing debt can be a daunting task, but with the right tools and strategies, you can take control of your finances and start paying off your debts. One of the most important steps in debt management is tracking your debt payments. In this article, we will explore five simple ways to track debt payments and help you get back on track.

Why Track Debt Payments?

Tracking debt payments is essential for several reasons:

- Stay organized: Keeping track of your debt payments helps you stay organized and ensures that you never miss a payment.

- Avoid late fees: Missing a payment can result in late fees, which can add up quickly. By tracking your payments, you can avoid these unnecessary charges.

- Build credit: Making timely payments is crucial for building credit. By tracking your payments, you can ensure that you’re making progress towards improving your credit score.

- Reduce stress: Managing debt can be stressful, but tracking your payments can help you feel more in control and reduce anxiety.

5 Simple Ways to Track Debt Payments

1. Spreadsheets

Creating a spreadsheet is a simple and effective way to track debt payments. You can use Google Sheets or Microsoft Excel to create a table with the following columns:

| Debt Type | Balance | Payment Due Date | Payment Amount |

|---|---|---|---|

| Credit Card | $1,000 | 15th of each month | $50 |

| Car Loan | $10,000 | 1st of each month | $200 |

2. Budgeting Apps

There are many budgeting apps available that can help you track debt payments. Some popular options include:

- Mint

- Personal Capital

- YNAB (You Need a Budget)

These apps allow you to link your accounts, track your spending, and set reminders for debt payments.

3. Debt Repayment Calendars

A debt repayment calendar is a visual tool that helps you track your payments. You can create a calendar using a paper planner or a digital tool like Google Calendar. Mark each payment due date and check it off once you’ve made the payment.

4. Automated Payment Reminders

Most banks and creditors offer automated payment reminders. You can set up reminders via email, text, or phone call to ensure you never miss a payment.

5. Pencil and Paper

For those who prefer a low-tech approach, using pencil and paper can be an effective way to track debt payments. Simply write down each debt, the balance, and the payment due date. Check off each payment as you make it.

Tips for Effective Debt Payment Tracking

- Make it a habit: Set aside time each week to review your debt payments and update your tracking system.

- Be consistent: Use the same tracking method each month to ensure accuracy and consistency.

- Review and adjust: Regularly review your debt payments and adjust your tracking system as needed.

📝 Note: Tracking debt payments is just the first step in debt management. Be sure to also prioritize debt repayment and consider consolidating debt or seeking the help of a financial advisor if needed.

Additional Resources

For more information on debt management and tracking debt payments, consider the following resources:

- National Foundation for Credit Counseling (NFCC)

- Federal Trade Commission (FTC) - Managing Debt

- Credit Karma - Debt Repayment Guide

By implementing one or more of these simple methods, you can take control of your debt payments and start building a stronger financial future.

Tracking debt payments is a crucial step in managing debt and achieving financial freedom. By using one or more of the methods outlined above, you can stay organized, avoid late fees, and build credit. Remember to make it a habit, be consistent, and review and adjust your tracking system regularly. With time and effort, you can take control of your finances and start building a brighter financial future.