Do Unpaid Interns Need to Fill Out Form I-9?

Understanding Form I-9 Requirements for Unpaid Interns

As an employer, it’s essential to understand the complexities of Form I-9 requirements, particularly when it comes to unpaid interns. While it’s natural to assume that unpaid interns are exempt from Form I-9 requirements, the reality is more nuanced. In this article, we’ll delve into the world of Form I-9 requirements for unpaid interns and explore the necessary steps to ensure compliance.

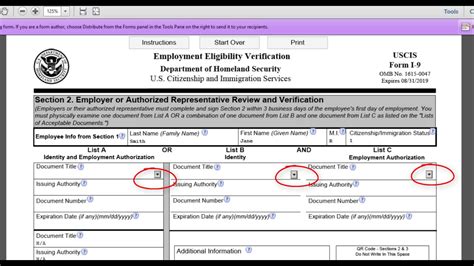

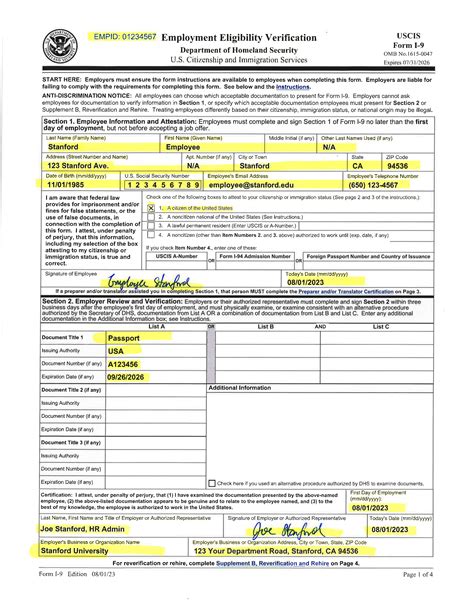

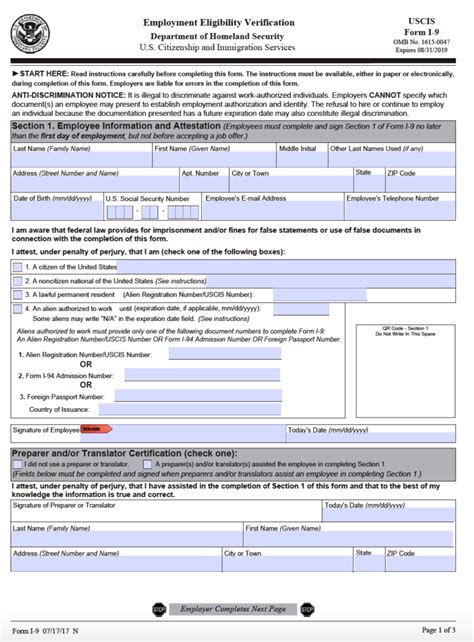

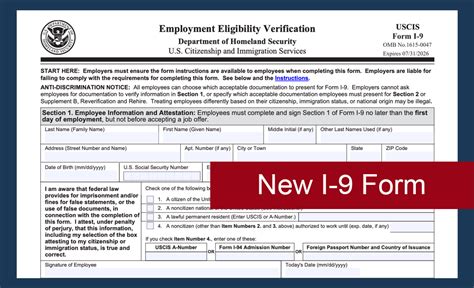

What is Form I-9?

Form I-9, Employment Eligibility Verification, is a crucial document that verifies the identity and employment authorization of individuals hired for employment in the United States. All U.S. employers are required to complete Form I-9 for each employee, including citizens and non-citizens, to confirm their eligibility to work in the country.

Who Needs to Fill Out Form I-9?

According to the U.S. Citizenship and Immigration Services (USCIS), all employees, including unpaid interns, who will be working for an employer in the United States, must complete Form I-9. The USCIS defines an employee as anyone who works for an employer in exchange for wages, compensation, or other remuneration.

Are Unpaid Interns Considered Employees?

The USCIS considers unpaid interns to be employees if they are receiving any form of compensation, including:

- Monetary wages

- Room and board

- Education credits

- Academic credit

- Other forms of compensation

If an unpaid intern is receiving any of these forms of compensation, they are considered an employee and must complete Form I-9.

When Are Unpaid Interns Exempt from Form I-9 Requirements?

Unpaid interns are exempt from Form I-9 requirements if they are not receiving any form of compensation, including:

- Volunteering for a non-profit organization

- Participating in a school-sponsored internship program

- Working for a family member or friend without receiving compensation

In these cases, the unpaid intern is not considered an employee and is not required to complete Form I-9.

What Are the Penalties for Non-Compliance?

Employers who fail to complete Form I-9 for unpaid interns or fail to maintain accurate records may face penalties, including:

- Fines ranging from 230 to 2,292 per form

- Imprisonment for up to two years

- Debarment from participating in federal contracts

📝 Note: It's essential to maintain accurate records and complete Form I-9 for all employees, including unpaid interns, to avoid penalties and ensure compliance with USCIS regulations.

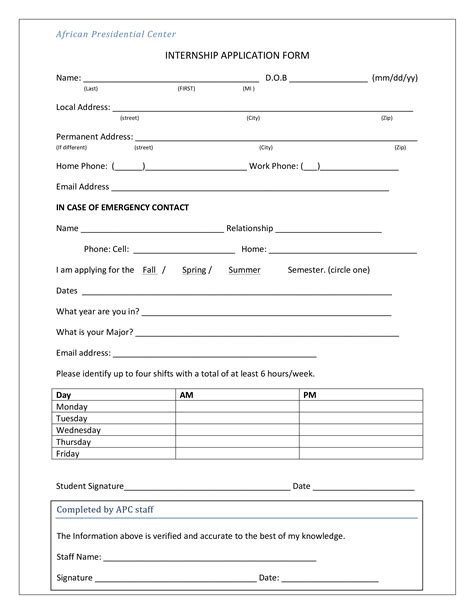

Best Practices for Completing Form I-9 for Unpaid Interns

To ensure compliance, follow these best practices:

- Complete Form I-9 for all unpaid interns who receive compensation

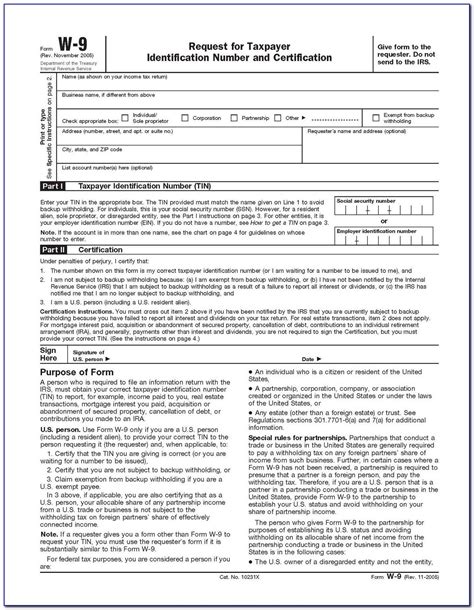

- Maintain accurate records, including the employee’s name, address, and social security number

- Verify the employee’s identity and employment authorization documents

- Retain completed Form I-9 for at least three years from the date of hire or one year from the date of termination

Conclusion

Unpaid interns may need to complete Form I-9, depending on the nature of their compensation. By understanding the requirements and following best practices, employers can ensure compliance and avoid penalties. Remember, it’s always better to err on the side of caution and complete Form I-9 for all unpaid interns who receive compensation.

Who is required to complete Form I-9?

+

All employees, including citizens and non-citizens, who will be working for an employer in the United States, must complete Form I-9.

Are unpaid interns considered employees?

+

Yes, unpaid interns are considered employees if they are receiving any form of compensation, including monetary wages, room and board, education credits, or other forms of compensation.

What are the penalties for non-compliance?

+

Employers who fail to complete Form I-9 or maintain accurate records may face penalties, including fines, imprisonment, and debarment from participating in federal contracts.