Free Printable Check Registers for Easy Money Tracking

Why Use a Check Register for Money Tracking?

In today’s digital age, it’s easy to overlook the importance of keeping track of our finances manually. With the rise of online banking and mobile payment apps, many of us have abandoned traditional methods of money tracking. However, using a check register can be a simple and effective way to stay on top of your finances, even if you don’t write checks frequently.

A check register is a basic tool that helps you keep track of your income and expenses, allowing you to see exactly where your money is going. By using a check register, you can:

- Monitor your account balances in real-time

- Identify areas where you can cut back on unnecessary expenses

- Avoid overdrafts and bounced checks

- Stay organized and in control of your finances

Benefits of Using a Printable Check Register

While digital banking and accounting tools have their advantages, there are several benefits to using a printable check register:

- Tactile experience: Writing down your transactions by hand can help you feel more connected to your money and more aware of your spending habits.

- No dependency on technology: You can use a printable check register anywhere, anytime, without needing a computer or smartphone.

- Easy to understand: A check register provides a clear and simple visual representation of your finances, making it easy to see where your money is going.

- Customizable: You can print out a check register that is tailored to your specific financial needs and preferences.

How to Use a Check Register for Money Tracking

Using a check register is a straightforward process that requires minimal setup. Here’s a step-by-step guide to get you started:

- Choose a check register template: Select a printable check register template that suits your needs. You can find many free templates online, or create your own using a spreadsheet or word processor.

- Set up your register: Write your account name and starting balance at the top of the register. Then, list each transaction in chronological order, including the date, description, and amount.

- Record deposits and withdrawals: Every time you make a deposit or withdrawal, write it down in your check register. Be sure to include the date, amount, and a brief description of the transaction.

- Keep your register up to date: Make it a habit to update your check register regularly, ideally every day or week.

- Reconcile your account: At the end of each month, reconcile your check register with your bank statement to ensure accuracy and catch any errors.

📝 Note: Be sure to keep your check register in a safe and secure location, such as a locked drawer or file cabinet.

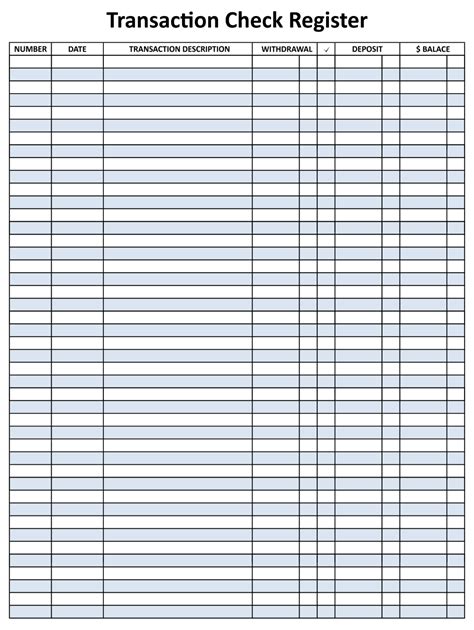

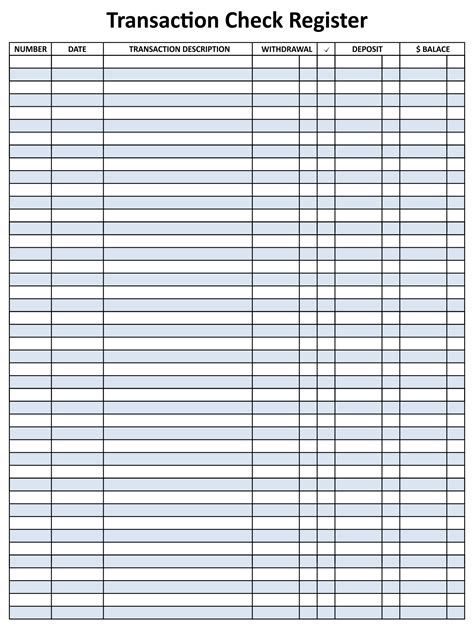

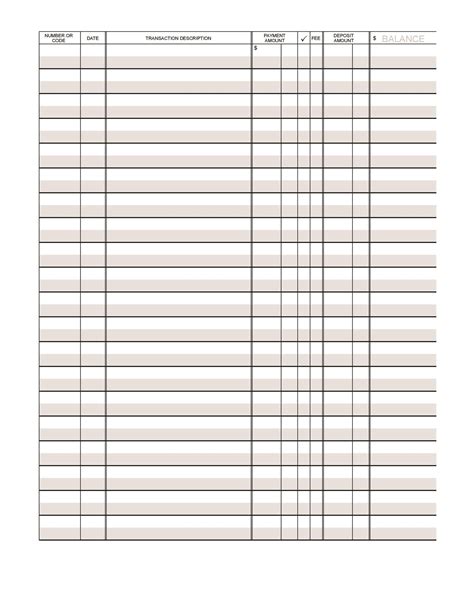

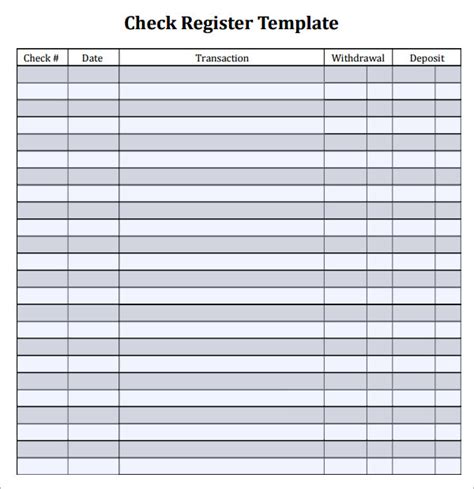

Free Printable Check Registers

To help you get started with using a check register, we’ve provided several free printable templates below. Simply click on the link to download and print your chosen template.

- Basic Check Register: A simple and straightforward template for tracking basic transactions.

- Budgeting Check Register: A template that includes columns for categorizing expenses and tracking budget progress.

- Small Business Check Register: A template designed for small business owners, with columns for tracking income, expenses, and receipts.

| Template Name | Description | Download Link |

|---|---|---|

| Basic Check Register | A simple template for tracking basic transactions | Download |

| Budgeting Check Register | A template for tracking expenses and budget progress | Download |

| Small Business Check Register | A template for small business owners to track income, expenses, and receipts | Download |

![39 Checkbook Register Templates [100% Free, Printable] ᐅ Templatelab 39 Checkbook Register Templates [100% Free, Printable] ᐅ Templatelab](https://foreman.hms.harvard.edu/assets/img/39-checkbook-register-templates-100-free-printable-o-templatelab.jpeg)

By using a printable check register, you can take control of your finances and achieve a better understanding of your money management habits.

Money management is a skill that takes time and practice to develop. By using a check register and following these simple steps, you can set yourself up for financial success and achieve your long-term goals.

What is a check register?

![39 Checkbook Register Templates [100% Free, Printable] ᐅ Templatelab 39 Checkbook Register Templates [100% Free, Printable] ᐅ Templatelab](https://foreman.hms.harvard.edu/assets/img/39-checkbook-register-templates-100-free-printable-o-templatelab.jpeg)

+

A check register is a tool used to track income and expenses, helping you stay on top of your finances and avoid overdrafts.

Why should I use a printable check register?

+

A printable check register provides a tactile experience, is easy to understand, and allows you to stay organized and in control of your finances.

How do I use a check register for money tracking?

![39 Checkbook Register Templates [100% Free, Printable] ᐅ Templatelab 39 Checkbook Register Templates [100% Free, Printable] ᐅ Templatelab](https://foreman.hms.harvard.edu/assets/img/39-checkbook-register-templates-100-free-printable-o-templatelab.jpeg)

+

Choose a check register template, set up your register, record deposits and withdrawals, keep your register up to date, and reconcile your account regularly.

Related Terms:

- Free printable check register PDF

- Free printable check register Word

- Free checkbook register template Excel

- Online check register template