Iowa Paycheck Calculator: Accurate Payroll Tax Estimates

Understanding Iowa Payroll Taxes: A Comprehensive Guide

As an employer or employee in Iowa, understanding payroll taxes is crucial for ensuring accurate calculations and compliance with state regulations. Iowa payroll taxes can be complex, with various rates and deductions to consider. In this article, we’ll break down the key components of Iowa payroll taxes and provide a step-by-step guide on how to use an Iowa paycheck calculator for accurate estimates.

Iowa Payroll Tax Rates and Withholding

Iowa employers are required to withhold state income tax from employee wages. The Iowa Department of Revenue provides a withholding tax table to help employers determine the correct amount of tax to withhold. The tax rates range from 0.36% to 8.98%, depending on the employee’s income level and filing status.

Iowa Income Tax Withholding Rates:

| Taxable Income | Tax Rate |

|---|---|

| 0 - 1,600 | 0.36% |

| 1,601 - 3,200 | 0.72% |

| 3,201 - 6,400 | 2.43% |

| 6,401 - 14,800 | 4.14% |

| 14,801 - 24,000 | 5.63% |

| $24,001 and above | 8.98% |

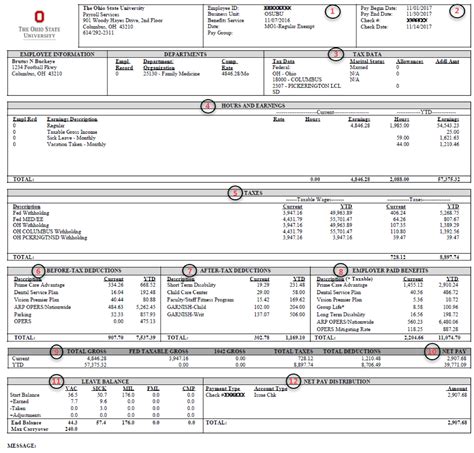

Other Iowa Payroll Taxes and Deductions

In addition to state income tax withholding, Iowa employers must also consider other taxes and deductions, including:

- Federal Income Tax Withholding: Employers must withhold federal income tax from employee wages, using the IRS’s tax tables.

- Social Security Tax: Employers must withhold 6.2% of employee wages for Social Security tax, and pay an additional 6.2% as the employer’s portion.

- Medicare Tax: Employers must withhold 1.45% of employee wages for Medicare tax, and pay an additional 1.45% as the employer’s portion.

- Federal Unemployment Tax (FUTA): Employers must pay FUTA tax on the first $7,000 of employee wages, at a rate of 6.0%.

- Iowa Unemployment Insurance: Employers must pay Iowa unemployment insurance taxes on the first $29,900 of employee wages, at a rate ranging from 0.6% to 6.0%.

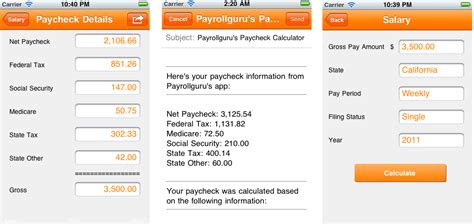

Using an Iowa Paycheck Calculator

To ensure accurate payroll tax estimates, employers can use an Iowa paycheck calculator. These calculators typically require the following information:

- Employee’s gross wages

- Employee’s filing status and number of dependents

- Employee’s state income tax withholding rate

- Other taxes and deductions (e.g., Social Security tax, Medicare tax, FUTA)

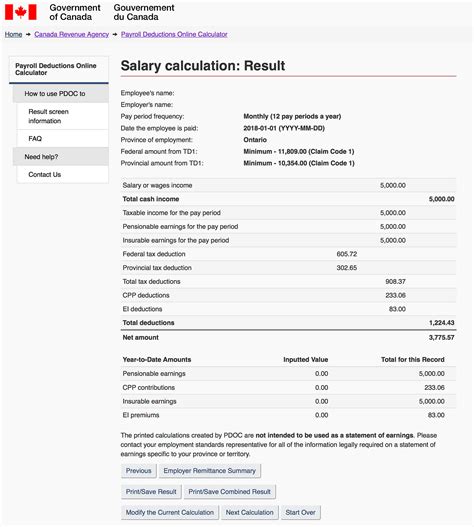

Step-by-Step Guide to Using an Iowa Paycheck Calculator:

- Gather employee’s pay information, including gross wages and filing status.

- Determine the employee’s state income tax withholding rate using the Iowa withholding tax table.

- Enter the employee’s information into the paycheck calculator.

- Calculate the total taxes and deductions, including federal income tax withholding, Social Security tax, Medicare tax, FUTA, and Iowa unemployment insurance.

- Review and adjust the calculations as necessary to ensure accuracy.

📝 Note: Employers should always verify the accuracy of their calculations with the Iowa Department of Revenue and the IRS to ensure compliance with state and federal regulations.

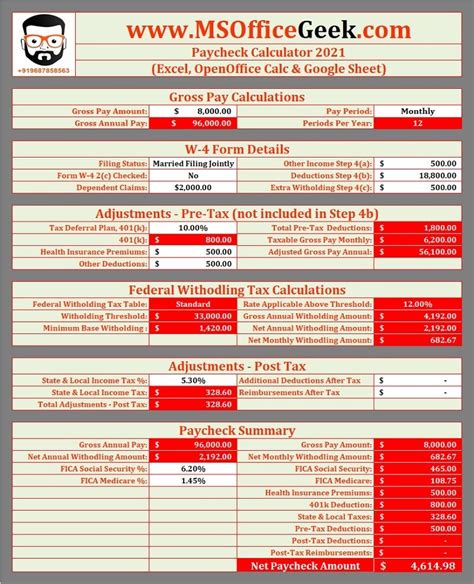

Example Iowa Paycheck Calculator Scenario

Employee Information:

- Gross wages: $4,000 per month

- Filing status: Single

- Number of dependents: 0

- State income tax withholding rate: 4.14%

Calculator Results:

- State income tax withholding: $166.40

- Federal income tax withholding: $434.00

- Social Security tax: $248.00

- Medicare tax: $58.00

- FUTA: $24.00

- Iowa unemployment insurance: $14.40

Total taxes and deductions: $944.80

Net Pay: $3,055.20

Conclusion

Accurate payroll tax estimates are crucial for Iowa employers to ensure compliance with state regulations and avoid penalties. By understanding Iowa payroll tax rates and using an Iowa paycheck calculator, employers can ensure accurate calculations and provide employees with the correct take-home pay.

Frequently Asked Questions

What is the Iowa state income tax withholding rate?

+

The Iowa state income tax withholding rate ranges from 0.36% to 8.98%, depending on the employee’s income level and filing status.

How do I determine an employee’s state income tax withholding rate?

+

Use the Iowa withholding tax table provided by the Iowa Department of Revenue to determine the employee’s state income tax withholding rate.

What other taxes and deductions must Iowa employers consider?

+

Iowa employers must also consider federal income tax withholding, Social Security tax, Medicare tax, FUTA, and Iowa unemployment insurance.