5 Ways to Calculate Your Maryland Income

Understanding Maryland Income Calculation

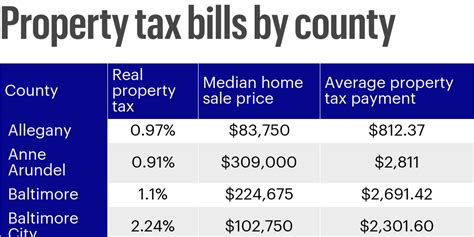

Calculating your Maryland income can be a bit complex, especially with the various tax laws and regulations in place. However, it’s essential to get it right to ensure you’re paying the correct amount of taxes and taking advantage of the deductions and credits available to you. In this article, we’ll explore five ways to calculate your Maryland income, helping you navigate the process with ease.

Method 1: Using the Maryland Tax Calculator

The Maryland tax calculator is a convenient tool provided by the state to help residents estimate their tax liability. To use the calculator, you’ll need to provide information about your income, filing status, and dependents. The calculator will then generate an estimate of your state income tax.

- Step-by-Step Process:

- Visit the Comptroller of Maryland’s website and click on the “Tax Calculator” link.

- Select your filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er)).

- Enter your total income from all sources, including wages, salaries, tips, and self-employment income.

- Add any dependents you’re claiming, including children and elderly or disabled relatives.

- Click “Calculate” to generate an estimate of your state income tax.

📝 Note: The tax calculator is only an estimate and may not reflect your actual tax liability.

Method 2: Using Tax Preparation Software

Tax preparation software like TurboTax, H&R Block, and TaxAct can help you calculate your Maryland income and file your state taxes. These programs guide you through the tax preparation process, asking questions about your income, deductions, and credits.

- Step-by-Step Process:

- Choose a tax preparation software that supports Maryland state taxes.

- Create an account or log in to an existing one.

- Answer questions about your income, including wages, salaries, tips, and self-employment income.

- Claim deductions and credits, such as the standard deduction, mortgage interest, and charitable donations.

- Review and submit your tax return electronically.

📊 Note: Tax preparation software may charge a fee for state tax filing.

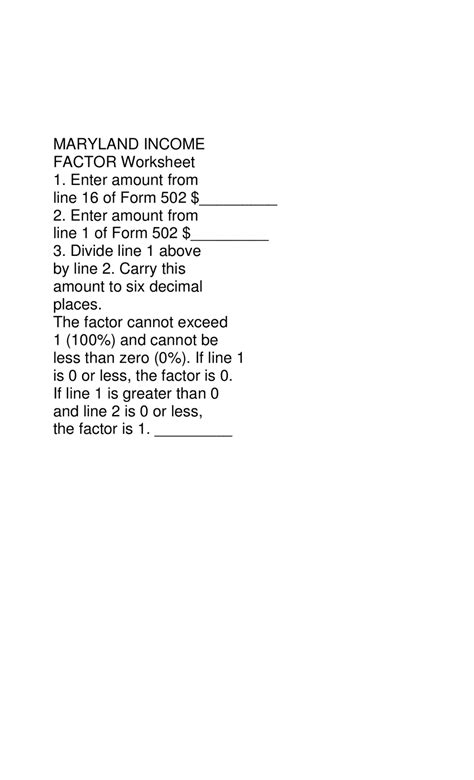

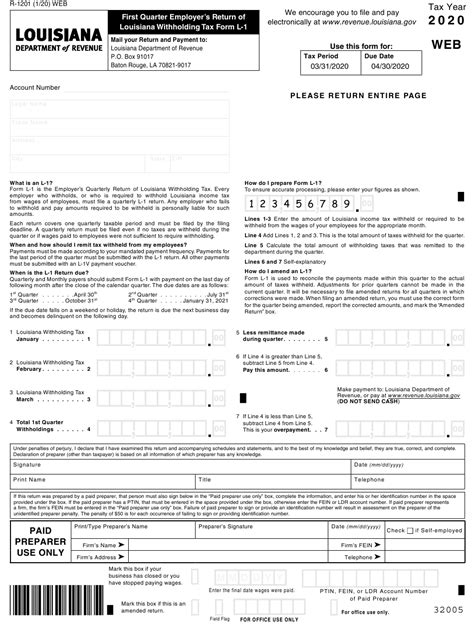

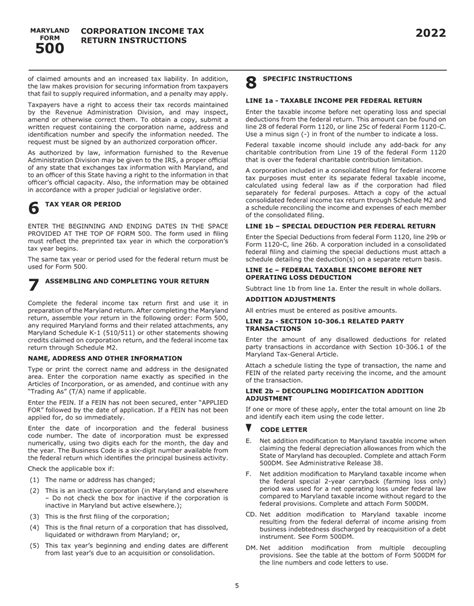

Method 3: Using the Maryland Tax Forms

If you prefer to file your taxes manually, you can use the Maryland tax forms available on the Comptroller’s website. This method requires you to calculate your income and taxes manually, using the instructions provided with the forms.

- Step-by-Step Process:

- Download and print the Maryland tax forms (502 and 502B) from the Comptroller’s website.

- Complete the forms, reporting your income from all sources, including wages, salaries, tips, and self-employment income.

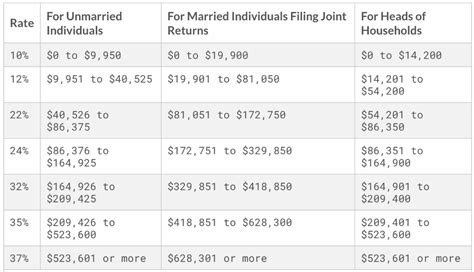

- Calculate your taxes using the tax tables or worksheets provided.

- Claim deductions and credits, such as the standard deduction, mortgage interest, and charitable donations.

- Mail your completed tax return to the Comptroller’s office.

📨 Note: Manual filing may take longer to process than electronic filing.

Method 4: Consulting a Tax Professional

If you’re unsure about calculating your Maryland income or need personalized guidance, consider consulting a tax professional. They can help you navigate the tax laws and ensure you’re taking advantage of all the deductions and credits available to you.

- Step-by-Step Process:

- Find a qualified tax professional, such as a certified public accountant (CPA) or enrolled agent (EA).

- Schedule a consultation to discuss your tax situation.

- Provide your tax professional with all necessary documents, including W-2s, 1099s, and receipts for deductions.

- Review and approve your tax return before submission.

💼 Note: Tax professionals may charge a fee for their services.

Method 5: Using a Tax Planning Service

Tax planning services, like those offered by financial advisors or accounting firms, can help you calculate your Maryland income and create a personalized tax plan. These services often include ongoing support and guidance throughout the year.

- Step-by-Step Process:

- Find a tax planning service that suits your needs.

- Schedule a consultation to discuss your tax situation and goals.

- Provide your tax planning service with all necessary documents, including W-2s, 1099s, and receipts for deductions.

- Review and approve your tax plan, including recommendations for deductions and credits.

📈 Note: Tax planning services may charge a fee for their services.

In conclusion, calculating your Maryland income requires attention to detail and a understanding of the state’s tax laws. By using one of the five methods outlined above, you can ensure you’re paying the correct amount of taxes and taking advantage of the deductions and credits available to you. Whether you choose to use a tax calculator, tax preparation software, or consult a tax professional, make sure to review your tax return carefully before submission.

What is the deadline for filing Maryland state taxes?

+

The deadline for filing Maryland state taxes is typically April 15th of each year, unless you file for an extension.

Can I file my Maryland state taxes electronically?

+

Yes, you can file your Maryland state taxes electronically using tax preparation software or the Comptroller’s website.

What is the standard deduction for Maryland state taxes?

+

The standard deduction for Maryland state taxes varies depending on your filing status and income level. You can find the most up-to-date information on the Comptroller’s website.