5 Easy Ways to Track Your Mileage

Why Tracking Your Mileage is Important

Tracking your mileage is an essential task for many individuals, whether you’re a business owner, freelancer, or employee who uses your vehicle for work-related purposes. Accurate mileage tracking can help you deduct business expenses on your tax return, receive reimbursement for work-related travel, and even monitor your vehicle’s maintenance needs. However, many people struggle to keep accurate records, which can lead to missed deductions, lost reimbursement, and poor vehicle maintenance.

Traditional Methods of Tracking Mileage

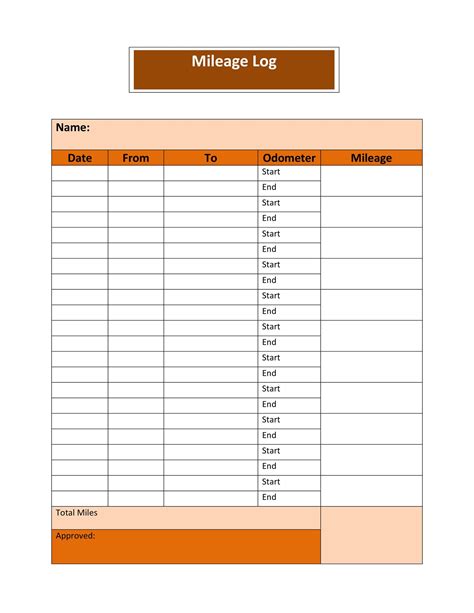

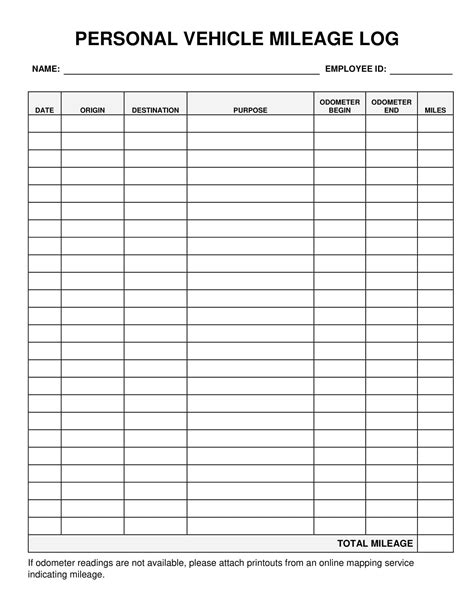

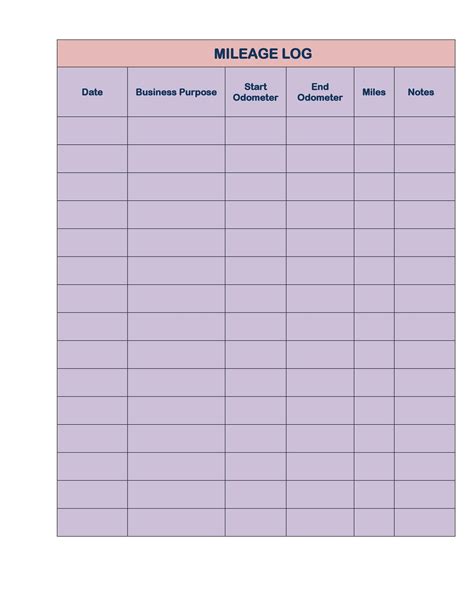

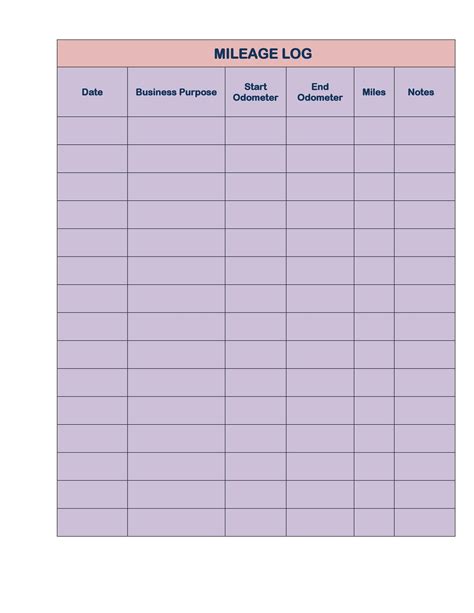

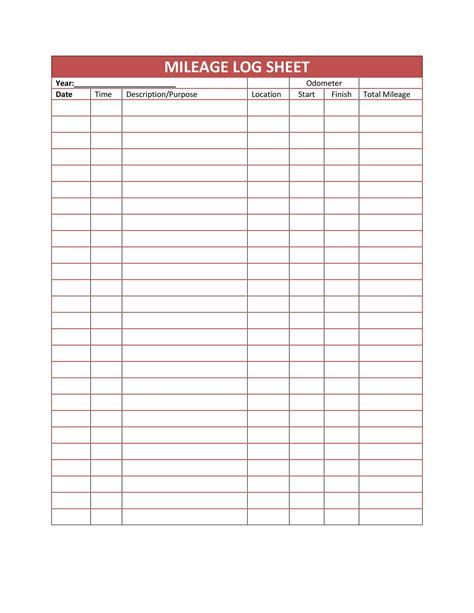

In the past, people relied on manual methods to track their mileage, such as logging trips in a notebook or using a spreadsheet. While these methods can be effective, they can also be time-consuming and prone to errors. For example, you may forget to log a trip or misrecord the mileage, which can lead to inaccuracies in your records.

Modern Solutions for Mileage Tracking

Fortunately, there are now many modern solutions available that make it easy to track your mileage accurately and efficiently. Here are five easy ways to track your mileage:

1. Mileage Tracking Apps

Mileage tracking apps are a popular solution for many individuals. These apps use GPS technology to track your trips and automatically log the mileage. Some popular mileage tracking apps include:

- MileIQ: A user-friendly app that allows you to track your mileage and generate reports for tax purposes.

- TripLog: An app that uses GPS to track your trips and provides detailed reports and summaries.

- Expensify: A comprehensive expense tracking app that includes mileage tracking features.

2. Automotive Devices

Automotive devices, such as GPS devices and dash cams, can also be used to track your mileage. These devices can be installed in your vehicle and provide accurate mileage tracking.

- Garmin: A popular GPS device that can track your mileage and provide turn-by-turn directions.

- Dash cams: A type of camera that can be installed in your vehicle to track your mileage and provide video evidence in case of an accident.

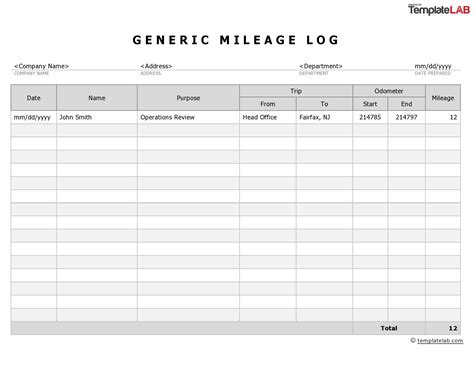

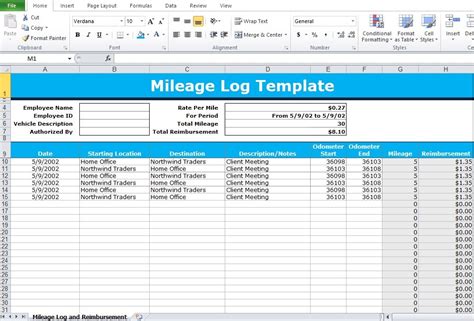

3. Spreadsheets

Spreadsheets are a simple and cost-effective way to track your mileage. You can create a spreadsheet using Google Sheets or Microsoft Excel and log your trips manually.

- Google Sheets: A free online spreadsheet that allows you to create and edit spreadsheets from anywhere.

- Microsoft Excel: A popular spreadsheet software that allows you to create and edit spreadsheets.

4. Mileage Tracking Software

Mileage tracking software is a more comprehensive solution that provides detailed reports and summaries. These software programs can be installed on your computer or accessed online.

- QuickBooks: A popular accounting software that includes mileage tracking features.

- Concur: A comprehensive expense tracking software that includes mileage tracking features.

5. GPS Tracking Devices

GPS tracking devices are a more advanced solution that provides real-time tracking and detailed reports. These devices can be installed in your vehicle and provide accurate mileage tracking.

- Fleet tracking devices: A type of GPS tracking device that is designed for fleets of vehicles.

- Personal GPS tracking devices: A type of GPS tracking device that is designed for individual use.

📝 Note: When choosing a mileage tracking solution, consider your specific needs and preferences. Some solutions may be more suitable for your needs than others.

Conclusion

Tracking your mileage is an essential task that can help you deduct business expenses, receive reimbursement, and monitor your vehicle’s maintenance needs. With the many modern solutions available, it’s easier than ever to track your mileage accurately and efficiently. Whether you prefer a mileage tracking app, automotive device, spreadsheet, mileage tracking software, or GPS tracking device, there’s a solution that’s right for you.

What is the best way to track mileage for taxes?

+

The best way to track mileage for taxes is to use a mileage tracking app or software that provides detailed reports and summaries. This can help you accurately track your mileage and deduct business expenses on your tax return.

Can I use a spreadsheet to track my mileage?

+

What is the difference between a mileage tracking app and a GPS tracking device?

+

A mileage tracking app is a software program that uses GPS technology to track your trips and provide detailed reports and summaries. A GPS tracking device, on the other hand, is a physical device that is installed in your vehicle and provides real-time tracking and detailed reports.

Related Terms:

- Free printable mileage log PDF

- Simple mileage log PDF

- Simple mileage log template

- Printable mileage log for taxes

- Mileage log template Excel download

- Excel mileage log