5 Easy Ways to Fill Out W-7 Form

Understanding the W-7 Form: A Guide to Easy Filing

The W-7 form, also known as the Application for IRS Individual Taxpayer Identification Number, is a crucial document for individuals who need to obtain an Individual Taxpayer Identification Number (ITIN) from the Internal Revenue Service (IRS). The ITIN is a unique nine-digit number assigned to individuals who are not eligible for a Social Security Number (SSN) but still need to file taxes or report income to the IRS. In this article, we will explore five easy ways to fill out the W-7 form, ensuring a smooth and hassle-free application process.

Step 1: Gather Required Documents

Before starting the application process, it is essential to gather all the required documents to avoid delays or rejections. The necessary documents include:

- A valid passport

- A national ID card

- A birth certificate

- A visa (if applicable)

- Proof of foreign status (if applicable)

📝 Note: Ensure that all documents are original or certified copies by the issuing agency.

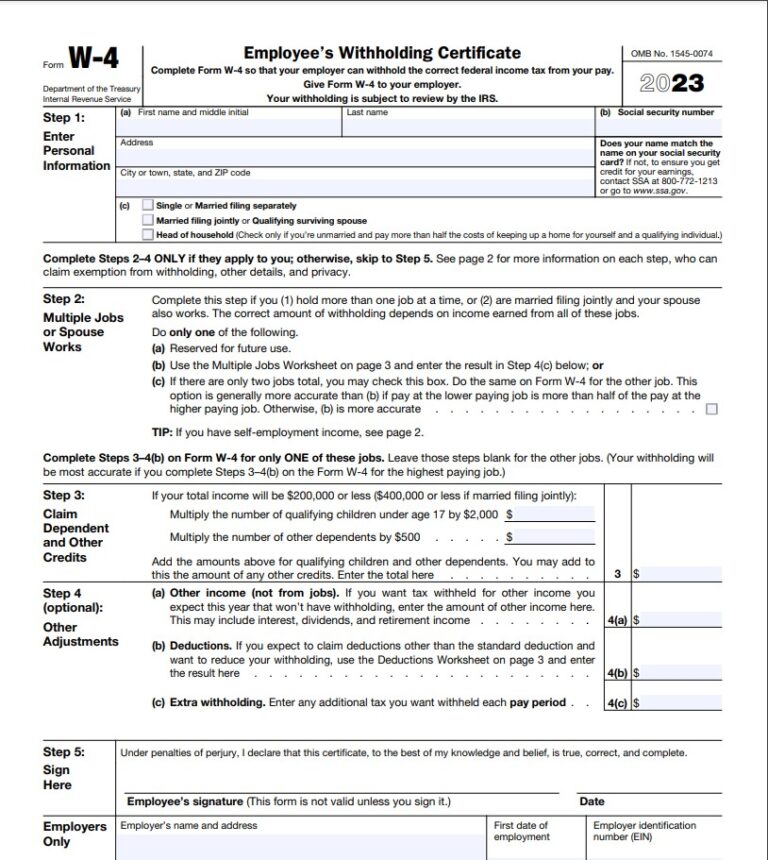

Step 2: Download and Complete the W-7 Form

The W-7 form can be downloaded from the IRS website or obtained by contacting the IRS directly. Once you have the form, fill it out carefully and accurately, making sure to provide all the required information, including:

- Your name and address

- Your date of birth

- Your country of birth

- Your foreign status (if applicable)

- The reason for applying for an ITIN

📝 Note: Use black ink and print clearly, as handwritten applications are not accepted.

Step 3: Attach Supporting Documents

Attach the required documents to the completed W-7 form, ensuring that they are properly certified and translated into English (if necessary). The documents should be attached in the following order:

- Passport or national ID card

- Birth certificate

- Visa (if applicable)

- Proof of foreign status (if applicable)

📝 Note: Make sure to use the correct attachment order to avoid delays.

Step 4: Apply for an ITIN

There are three ways to apply for an ITIN:

- Mail: Mail the completed W-7 form and supporting documents to the IRS address listed in the form instructions.

- In-person: Apply in person at an IRS Taxpayer Assistance Center (TAC) or an Acceptance Agent authorized by the IRS.

- Through a Certified Acceptance Agent: Apply through a Certified Acceptance Agent authorized by the IRS.

📝 Note: Ensure that you follow the correct application procedure to avoid delays or rejections.

Step 5: Review and Submit the Application

Carefully review the completed W-7 form and supporting documents to ensure accuracy and completeness. Once you have verified the information, submit the application via mail, in-person, or through a Certified Acceptance Agent.

📝 Note: Double-check the application for errors or omissions to avoid delays or rejections.

In conclusion, filling out the W-7 form is a straightforward process that requires attention to detail and accuracy. By following these five easy steps, you can ensure a smooth and hassle-free application process, obtaining your ITIN in no time.

What is the purpose of the W-7 form?

+

The W-7 form is used to apply for an Individual Taxpayer Identification Number (ITIN) from the IRS.

Who needs to file the W-7 form?

+

Individuals who are not eligible for a Social Security Number (SSN) but need to file taxes or report income to the IRS.

What documents are required to support the W-7 form?

+

A valid passport, national ID card, birth certificate, visa (if applicable), and proof of foreign status (if applicable).