7 Key Responsibilities of a Financial Manager

Understanding the Role of a Financial Manager

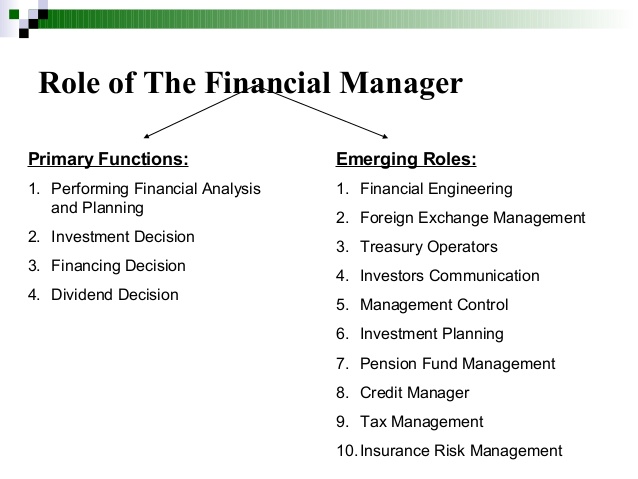

A financial manager plays a crucial role in the success of any organization. They are responsible for managing the financial aspects of the business, making strategic financial decisions, and ensuring the long-term financial stability of the company. In this article, we will explore the 7 key responsibilities of a financial manager.

Responsibility 1: Financial Planning and Budgeting

The first responsibility of a financial manager is to create a comprehensive financial plan and budget for the organization. This involves analyzing the company’s financial data, identifying areas for improvement, and developing a financial strategy that aligns with the company’s goals and objectives.

- Key tasks:

- Analyze financial data and market trends

- Develop a financial plan and budget

- Identify areas for cost reduction and improvement

- Present financial plans and budgets to stakeholders

Responsibility 2: Financial Reporting and Analysis

The second responsibility of a financial manager is to prepare and analyze financial reports, including balance sheets, income statements, and cash flow statements. This involves ensuring that financial reports are accurate, complete, and comply with regulatory requirements.

- Key tasks:

- Prepare financial reports, including balance sheets, income statements, and cash flow statements

- Analyze financial data and identify trends and areas for improvement

- Develop and implement financial models and forecasts

- Present financial reports and analysis to stakeholders

Responsibility 3: Investment and Funding

The third responsibility of a financial manager is to manage the company’s investments and funding. This involves analyzing investment opportunities, managing risk, and ensuring that the company has sufficient funding to meet its financial obligations.

- Key tasks:

- Analyze investment opportunities and manage risk

- Develop and implement investment strategies

- Manage funding and ensure sufficient liquidity

- Present investment and funding plans to stakeholders

Responsibility 4: Risk Management

The fourth responsibility of a financial manager is to identify and manage financial risks, including market risk, credit risk, and operational risk. This involves developing and implementing risk management strategies and ensuring that the company is adequately insured.

- Key tasks:

- Identify and assess financial risks

- Develop and implement risk management strategies

- Ensure adequate insurance coverage

- Present risk management plans to stakeholders

Responsibility 5: Tax Planning and Compliance

The fifth responsibility of a financial manager is to manage the company’s tax obligations, including tax planning and compliance. This involves ensuring that the company is in compliance with all tax laws and regulations and that tax liabilities are minimized.

- Key tasks:

- Develop and implement tax plans and strategies

- Ensure compliance with tax laws and regulations

- Manage tax audits and disputes

- Present tax plans and compliance reports to stakeholders

Responsibility 6: Financial Compliance and Governance

The sixth responsibility of a financial manager is to ensure that the company is in compliance with all financial regulations and laws, including financial reporting requirements and corporate governance standards.

- Key tasks:

- Ensure compliance with financial regulations and laws

- Develop and implement financial policies and procedures

- Manage financial audits and reviews

- Present financial compliance and governance reports to stakeholders

Responsibility 7: Financial Leadership and Team Management

The seventh and final responsibility of a financial manager is to provide financial leadership and manage a team of financial professionals. This involves developing and implementing financial strategies, managing financial resources, and providing guidance and support to team members.

- Key tasks:

- Provide financial leadership and guidance

- Manage a team of financial professionals

- Develop and implement financial strategies

- Present financial plans and reports to stakeholders

💡 Note: The specific responsibilities of a financial manager may vary depending on the organization, industry, and location.

In conclusion, a financial manager plays a critical role in the success of any organization. Their responsibilities include financial planning and budgeting, financial reporting and analysis, investment and funding, risk management, tax planning and compliance, financial compliance and governance, and financial leadership and team management. By understanding these responsibilities, organizations can ensure that their financial manager is equipped to make strategic financial decisions and drive long-term financial success.

What are the key responsibilities of a financial manager?

+

The key responsibilities of a financial manager include financial planning and budgeting, financial reporting and analysis, investment and funding, risk management, tax planning and compliance, financial compliance and governance, and financial leadership and team management.

What skills and qualifications are required to be a financial manager?

+

A financial manager typically requires a bachelor’s degree in finance or accounting, as well as relevant work experience and professional certifications, such as the Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA) designations.

What is the average salary for a financial manager?

+

The average salary for a financial manager varies depending on the organization, industry, and location, but it can range from 100,000 to over 200,000 per year.